5 Tips for The Best Cheap Life Insurance in New Zealand

- Willi Olsen

- Updated

Cheap life insurance in New Zealand is something everybody ideally wants.

But, like me, you don’t want cheap if the quality is not ideal.

The ever-increasing yearly renewable premiums make life insurance unaffordable.

You want a reputable and quality policy at the very best price.

Thankfully, cheap life insurance in New Zealand is something, you and I can do something about.

Most people don’t think much about life insurance… until they start a family or buy a house, and suddenly realise they are grown-ups.

When you have partner or children, you need to make sure they will be financially secure if you are not around anymore, without diverting too much money from other goals like retirement or paying the debt.

I have put together five key points, which I think are relevant to cheap life insurance in New Zealand.

Tip #1: Bundle insurance products if you can

One way to get cheap life insurance in New Zealand is to bundle coverage: life cover, trauma insurance, income protection and mortgage protection insurance nz.

Often, I come across people that have several small policies with several insurers.

This is an expensive way to be covered.

An excellent strategy to maximise your bundled discounts is to review all of your policies simultaneously.

The team at LifeCovered is trained and has many years of experience working with all leading New Zealand Insurers.

We do the hard work to get you the best deal.

This is more work in the short term, but can pay huge dividends and offer significant savings in the long run.

Tip #2: Stop Smoking

Besides the obvious health and quality-of-life benefits, quitting smoking is also one of the best ways to save money.

As anyone who smokes and owns a life cover policy can confirm, life insurance is more expensive for smokers.

There are two ways that you can get cheap life insurance in New Zealand after you stop smoking.

- The first and simplest way to do this is to reapply for a new non-smoker health rating on an existing policy.

Reapplying is very common, and I am frequently contacted by New Zealanders who have stopped smoking to help them save money on life insurance. - The second option is to get a brand new life insurance policy.

Some insurers are not willing to reevaluate your policy, so the best option is to take out a new policy at a non-smoker rate. Start by getting an online life insurance quote.

Tip #3: Fixed Insurance Payments

What is cheap today may be very expensive in 20 years.

Many Kiwis mistakenly believe that the best life insurance deal is the life insurance policy with the lowest price.

The best life insurance companies in New Zealand all offer fixed rates, so you can lock in premiums until you are 65, 70, or 80 or even 100.

Level life insurance policyholders will generally save thousands in their premiums by avoiding massive price increases in the future.

Cheap life insurance in New Zealand is related to you wanting premiums that increase yearly or pay a little more now and stop increasing premiums.

More about Stepped vs Level Premiums.

Tip #4: Be as healthy as you can mean cheap life insurance in New Zealand

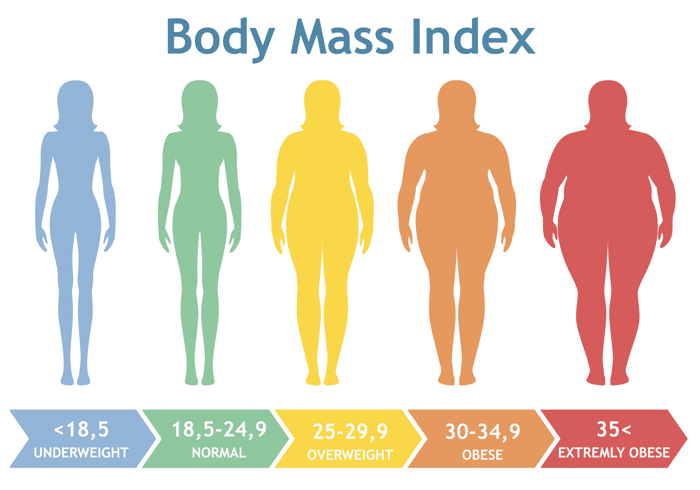

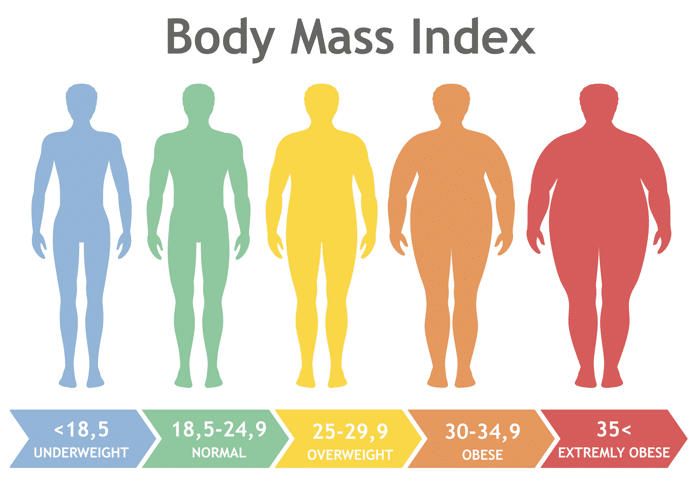

Many people don’t consider BMI or Body Mass Index when looking for life insurance.

BMI is used to compare your height and weight as a rough estimate of fat content in your body.

BMI is beneficial for many reasons, and it is good to know when offering someone life insurance.

Your BMI can affect your overall risk for long-term illnesses and health conditions.

There are healthy BMI ranges and ranges for underweight, overweight, and obese people.

When buying life insurance and BMI falls outside of normal ranges, this can cause marginal to significant increases in premiums.

A premium increase goes by the term ‘loading‘ in the industry.

If your BMI is out of range, typically on the overweight side, you can even be deferred by some companies for some years.

Being Overweight can be due to an existing health condition, and insurers want to consider this before offering life insurance.

Someone being obese is at a higher risk of high cholesterol, high blood pressure, diabetes and other health issues.

Most fit and healthy individuals have nothing to worry about, although plenty of studies show that someone with a healthy BMI who follows a proper healthy diet and exercises frequently can still develop these disorders.

There are many things to consider, but I am sure you understand your BMI can influence your life insurance premiums.

Tip #5: Don’t Wait

Generally speaking, the younger and healthier you are, easier it is to get cheap life insurance in New Zealand is for you.

And you can save thousands of dollars over your lifetime by starting young.

Lifestyle changes like marriage and children mean other people depend on you.

And rather than waiting, get a life cover policy now. The most significant reason for increases is that your health can change quickly.

It is harder to buy life insurance at age 50 because you pose a higher risk to the insurance company with each passing year.

The average life expectancy in New Zealand is 80.0 years for men and 83.3 for women; the closer you are, the greater the risk an insurer takes by offering you coverage.¹

Conclusion: Cheap Life Insurance In New Zealand

What you and I perceive as cheap life insurance in New Zealand depends on more than just the price of one isolated policy.

The length of time you need the policy, your health, and the insurance company’s record for paying claims all determine the cheapest and best option for you.

Talk to us at LifeCovered about cheap life insurance in New Zealand. And we ensure you end up with something just right for you and your budget.

Find the Best Life Insurance Plan for You

Get free quotes and compare life insurance policies online

Our Beliefs

Here To Serve You!

We are focus on you, how to get the best value for money and financial protection accordingly.

Expert Advisers

We know our stuff and will never sell you anything. We educate and advise.

Contact us

We would love to hear from you if you want to know more about our services, a career opportunity or a business partnership. Email us at friends (at) lifecovered.nz

Popular Articles