- 93% of all claims paid

- Allow credit card payments

- First 2 months free

- Level premiums can't be inflation adjusted

- Confusion around multi-channel product distribution

Unique to Chubb Life, client benefits provide extra support when you need it most. Policyholders can claim up to $1,000 during a year for legal, career, and budgeting advice or mental health counselling at no extra cost.

For a personalised Chubb insurance quote, call LifeCovered on 0800259925 or book a complimentary consultation for financial advice.

Chubb Life

Based on our research, Chubb is one of the best life insurance companies in New Zealand.

It is a leading specialist provider of life insurance, funeral insurance, income protection insurance, trauma insurance, and travel insurance products and services, protecting more than 450,000 customers with simple, affordable insurance products and services.

Chubb Life Insurance Review

Types of Insurance Policies Sold by Chubb Life

Chubb Life offers two policy types via its insurance broker channel:

- Personal Insurance, called Assurance Extra and

- Business Insurance, called Assurance Extra Business.

Personal Insurance

Assurance Extra is a master policy for your personal life and living insurance needs. It offers nine different covers, which you can choose from to suit your needs and budget.

You’ve worked hard to get where you are today, and along the way, you are likely to have come to appreciate a number of areas in your life that are important to you, such as your family, your income, your home, your health and your lifestyle.

But what if the unexpected should happen – how can you protect the things you value? This is why insurance is so important.

Life Insurance

Insurance that pays you a lump sum if you die or are diagnosed with a terminal illness.

Trauma Insurance

Insurance that pays you a lump sum amount if you get a defined illness or condition for the first time.

Complete Disablement Cover

Insurance that pays you a lump sum amount if you become completely disabled as a result of illness or injury.

Income Protection Insurance

Insurance that pays you a monthly amount to compensate for your lost income if you were to become disabled as a result of illness or injury.

Mortgage Repayment Insurance

Insurance that pays you a monthly amount to help cover your mortgage repayments or rent or to compensate you for lost income if you were to become disabled as a result of illness or injury

Redundancy Cover

Insurance that pays you a monthly amount for up to 6 months if you are made involuntarily redundant.

Specific Injury Cover

Insurance that pays you a lump sum amount if you sustain one of the covered injuries as a result of an accident.

Premium Cover

Insurance that pays your total premiums needed to continue your policy if you become disabled, or are made redundant or declared bankrupt.

Business Insurance

Assurance Extra Business is a master policy for your business needs. It offers seven different types of cover, which you can choose from to suit your business needs and budget.

Running your own business is one of the most rewarding jobs. And watching it succeed makes all your hard work worthwhile.

That’s why it’s important to have the right insurance and succession planning in place. It means you can control what happens in the future if something unexpected was to happen to you or a key person in your business.

Protecting your business

We can help with a number of insurance solutions to help protect your business from the impact of illness, injury or death.

Business insurance provides a vital cash injection so your business can continue to operate if one of the people covered should suffer an injury or illness or pass away.

There are a few things to consider when it comes to protecting your business and family against the unknown.

Could your business repay debt or suppliers?

- What if you got seriously ill and couldn’t work?

- Do you have a buy/sell agreement in place?

- Would you and your family be able to survive financially if these situations arose?

- Think about how the following areas of your business would be affected if life threw something unexpected your way.

The company offers a 30-day free look period. You can cancel the policy for a full refund during that time.

Chubb New Zealand Timeline

Chubb New Zealand in the news

2021:

Cigna Corporation announced its intention to sell Cigna New Zealand to Chubb, one of the world’s largest publicly-traded insurance companies

2020:

Cigna completes the integration of OnePath into its business, uniting the two companies under the Cigna brand.

2019: Cigna rolls out a number of changes to its OnePath Life product range, introducing various improvements in cover.

2019:

Cigna opens an office in Christchurch, the company’s first bricks-and-mortar presence on the South Island.

2018:

Cigna partners with UK technology UnderwriteMe, and launches its Underwriting Rules Engine (URE) in New Zealand.

2018:

Cigna New Zealand appoints Gail Costa as its new CEO.

2018:

Cigna enters a 20-year strategic alliance to provide insurance solutions for ANZ bank customers

2018:

Cigna announces its intention to acquire OnePath Life for $700 million from ANZ in May, and the deal is granted regulatory approval in November.

2017:

Cigna New Zealand has its financial strength rating upgraded from A- to A by A.M. Best as a result of a “strong balance sheet and long-term sustainability.”

1986: Cigna New Zealand is founded by Cigna Corporation, a Fortune500 company.

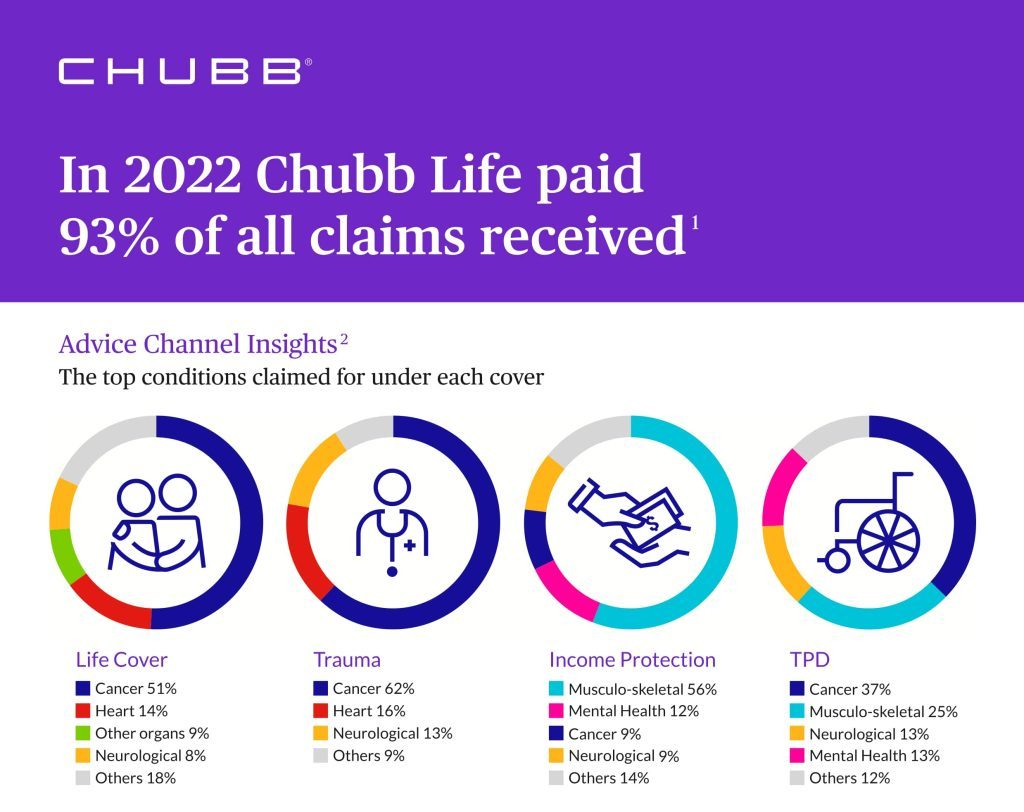

Chubb Life NZ Claims Paid

For life cover, most of the claims (64%) were for females aged 50 to 59 and males aged 60 to 69. 51% of all life cover claims were related to cancer, with heart-related claims coming a distant second at 14%.

Cancer also topped the firm’s trauma cover list at 62%, with heart claims sitting at 16%.

Musculo-skeletal topped the firm’s income protection claims at 56%, and claims for mental health amounted to 12% under this category.

For TPD, cancer again topped the list at 37%, a quarter were for musculo-skeletal, and 13% related to neurological disorders.

And of income cover claims, 64% were made by those aged 30 to 49.

Chubb Life NZ Reviews and Recognition

The company’s product range includes term life, disability income, trauma, and funeral insurance.

Chubb Life NZ distributed its financial products via multiple channels, particularly benefiting from a bancassurance distribution agreement with ANZ Bank New Zealand Limited, TSB Bank New Zealand, and its insurance broker adviser channel.

Customers may find the distribution of Chubb financial products via multiple channels confusing as these products are priced and marketed individually, as is the product quality.

- Forty-nine customers have rated Chubb Life NZ 2.7 stars on Google My Business.

- Most trusted brands in a Reader’s Digest consumer survey.

About Chubb Life

Chubb Life Insurance New Zealand Limited (Chubb Life), formerly Cigna New Zealand, based in Takapuna, Auckland, was founded on 13 Dec 1967 and provides life insurance, income protection cover, critical illness, and business insurance products via LifeCovered and other brokers.

Chubb Life Quick Facts

- Year established: 1967

- Location of headquarters: Majestic Centre, Wellington

- How to buy Chubb life insurance: Chubb Life policies are available through financial advisors such as LifeCovered.

Chubb Life NZ FAQ

Chubb Life NZ’s parent company is Chubb Limited, a Fortune 500 company listed on the New York Stock Exchange (NYSE: CB) and a component of the S&P 500 index.

On July 1 2022, Chubb, the world’s largest publicly traded property and casualty insurer, acquired Cigna’s life and non-life insurance companies in six Asia-Pacific markets, including New Zealand and changed its name to Chubb Life Insurance New Zealand.