Wellbeing One vs Wellbeing Two:

Comparison 2024

- By Willi Olsen

- Updated

Is Wellbeing One or Wellbeing Two better?

Private medical insurance in New Zealand has come a long way. The idea that New Zealanders should have access to high-quality private healthcare choices led to the founding of the Southern Cross non-profit organisation.

Southern Cross’s two best-selling health plans are Wellbeing One and Wellbeing Two.

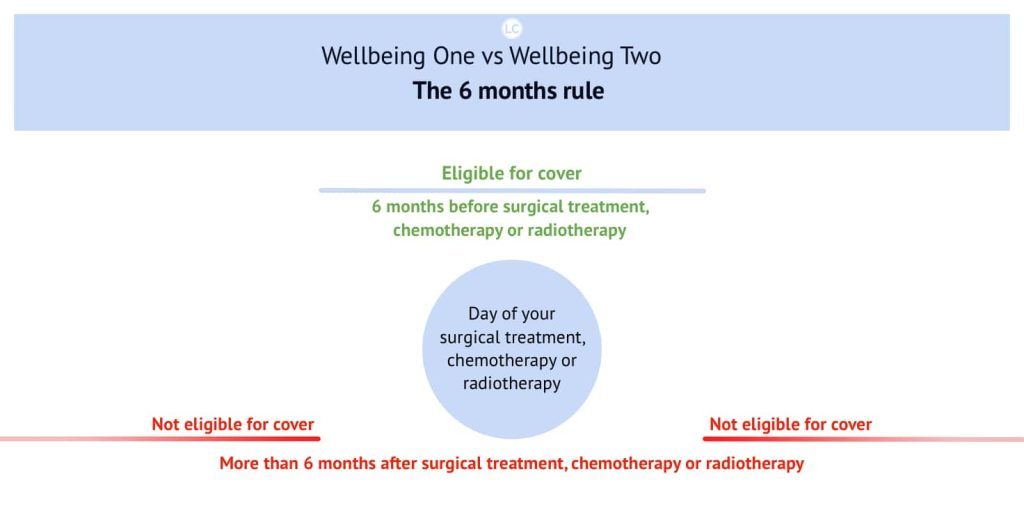

Wellbeing One varies from Wellbeing Two in that it covers expert consultations, diagnostic imaging, and testing conducted within six months after surgery, chemotherapy, or radiation treatment.

So, Wellbeing Two provides the same benefits as Wellbeing One, but there is no time restriction of six months.

Wellbeing One vs Wellbeing Two

Wellbeing One and Wellbeing Two are Southern Cross’s two most popular health insurance plans because they accommodate a wide range of needs, from major medical surgery to routine checkups and peace of mind. Unfortunately, pre-existing conditions are not covered.

What’s covered by Southern Cross’ Wellbeing One policy?

- Chemotherapy or unlimited radiotherapy

- Unlimited Surgical treatment

- Specialist consultations

- Diagnostic imaging and tests within six months of related eligible surgical treatment.

What is the 6 months rule?

What’s covered by Southern Cross’ Wellbeing Two policy?

Wellbeing Two is a popular broad surgical and healthcare plan by Southern Cross, and the policy will reimburse 100% of expenses, up to the specified policy limit, for eligible healthcare services.

The six months rule does not apply.

Specialist consultations, diagnostic imaging, and tests are covered within the policy limits whether or not you undergo surgical treatment, chemotherapy, or radiotherapy.

- Chemotherapy or unlimited radiotherapy

- Unlimited Surgical treatment

- Specialist consultations

- Diagnostic imaging and tests.

- Obstetrics allowance available after one year of continuous cover

What’s the difference?

Wellbeing Two provides the same cover as Wellbeing One but covers Specialist consultations, diagnostic imaging and tests whether or not you undergo surgical treatment, chemotherapy or radiotherapy.

The Obstetrics benefit of $750 per claims year is available after one year of continuous cover.

Regular Care Vs Wellbeing One and Two

The main difference is the excess is 20% of the claim with Regular Care vs Wellbeing One it’s limited to a fixed dollar amount such as $500 for instance. Secondly, the surgical benefit is limited to $100k per operation with Regular Care vs Wellbeing One, it’s unlimited.

How does excess on Wellbeing One vs Wellbeing Two work?

Excess on Wellbeing One and Two is paid once every policy year, no matter how many times you claim. Therefore, the excess applies to each person on your policy once per claims year.

Which Wellbeing One and Two benefits does the excess apply to?

- Surgical treatment

- Surgical allowances

- Chemotherapy

- Radiotherapy

- Recovery

- Psychiatric hospitalisation

- Obstetrics allowance (Wellbeing Two only)

Your excess does not apply to any other benefits. Please see your policy document for full terms and conditions

Who is Southern Cross Health Insurance?

New Zealand’s largest health insurer, Southern Cross Health Insurance, is wholly owned by the non-profit Southern Cross Medical Care Society and covers a wide range of health insurance plans from Surgery and Specialists, Cancer care, and Diagnostic imaging and tests.

Via its subsidiary, Southern Cross Health Trust, Southern Cross owns and operates New Zealand’s largest private healthcare network.

FAQ's

What is excess?

An excess is an amount you will need to pay before SouthernCross will reimburse you or pay your health services provider for the eligible healthcare service you have received. You will pay the excess amount directly to your health services provider. The higher the excess amount, the lower your premiums will be.

Which excess options?

The Wellbeing annual excess is available on the Wellbeing One and Wellbeing Two plans. You can choose the level of excess:

- $500,

- $1,000,

- $2,000 or

- $4,000.

How does the excess apply?

The excess applies to each person on your policy once per claims year. So, if there are three members on your policy, all three will need to pay the excess each claims year before being reimbursed for any eligible healthcare services they receive. Once the full amount of each member’s excess has been applied, no excess will apply to any further claims by that member in that particular claims year.

What is a claims year?

Your claims year is the 12 months following your policy start date and every 12 months from your policy anniversary date. You can check this date in “My Southern Cross” and your Membership Certificate.

The claims year that applies to a particular claim is based on the date you received the healthcare service, not when you send Southern Cross your claim or when Southern Cross pay your health services provider.

At the beginning of each member’s new claims year, their excess will be reset to its original, full value.