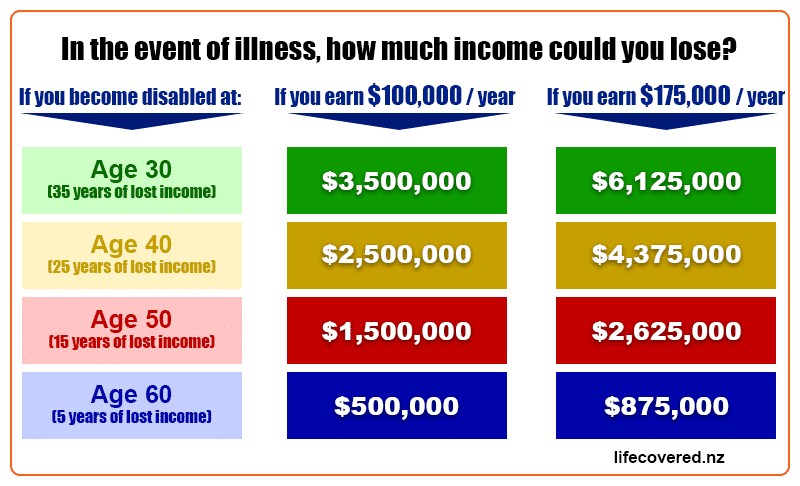

Compare Best Income Protection Insurance March 2024

- Willi Olsen

- Updated

We’ve selected the best disability insurance companies to help replace your income if you become medically unfit to work.

Income protection can replace up to 75% of your pre-disability income if you cannot work in the future.

In my experience, when helping professionals and high-income earners, I have seen firsthand the importance of protecting the family with a salary continuation insurance backup plan in case a disability incapacitates someone.

Disability insurance could help you pay the bills if you face an illness or injury that keeps you from working.

Compare Best Disability Insurance Companies

- AIA Insurance

- Asteron Life

- Chubb Life NZ

- Fidelity Life NZ

- Partners Life

Income Protection Insurance keeps your lifestyle going by paying up to 75% of your income if you were unable to work due to injury, illness or disability.

When the unexpected happens, we know what matters is if you can manage your expenses (mortgage, rent, food, utilities) while you recover.

Another thing to consider is that Income Protection Insurance Premiums are tax-deductible. Whereas Mortgage Protection Insurance premiums are not.

We compare the best income protection policies in New Zealand.

It is simple to arrange and tailored to you and your circumstances.

Introduction to Income Protection Insurance

Short term cheap income protection vs long term income protection

Income Protection is an insurance policy that pays a monthly benefit for an agreed period. The shorter the benefit period, the cheaper the policy is. It’s important to know the difference:

- short term income protection vs.

- long term income protection.

Short Term Income Protection (payable 2 to 5 years)

Short Term Income Protection policies pay an agreed income, after an agreed waiting period for 2 to 5 years.

It is your decision and responsibility how you spend the money.

Once the benefit period ends, no further benefit is paid so if you are still ill or injured, your policy will no longer help.

For these reasons, short term policies are cheaper than long term policies because the risk (and cost) to the insurer is much lower.

Long Term Income Protection (payable until age 65 or 70)

Long Term Income Protection income pays a regular income benefit until age 65 or 70. Naturally comparing short term income protection vs long term income protection, the cost is higher for long term income protection.

1. Cost of Income Protection Insurance NZ

Income protection insurance in New Zealand is the one insurance where you have a lot of control over the premium cost because the waiting period, benefit period and agreed value or indemnity value are all factors that you can select.

– Your cost, without income protection insurance

The real question to consider, is how much are you worth?

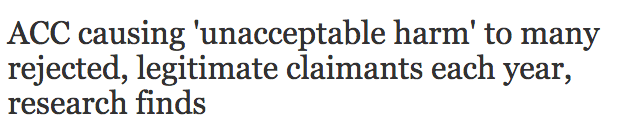

Job A: earns $100,000 per year and if disabled has no income going forward.

Job B: earns $98,000 per year and if disabled earns $62,250 ongoing.

Which job would you prefer?

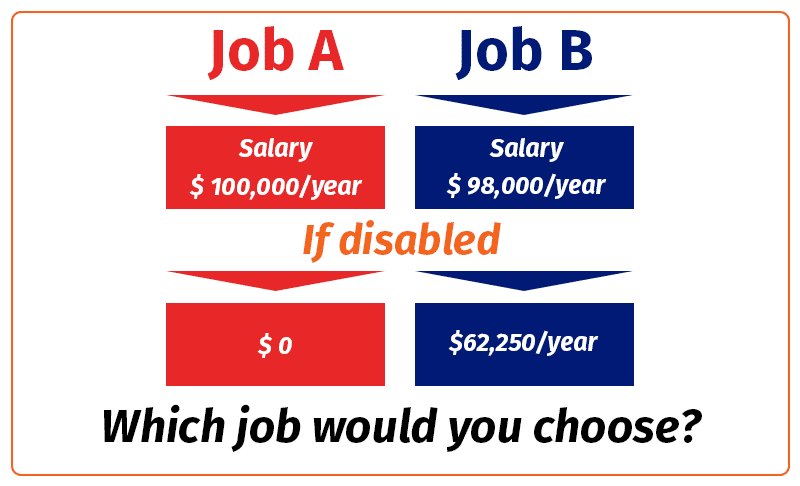

Now, look at the following chart and imagine your future income and earnings.

Do I need to ask if you consider your ability to earn an income significant enough to ensure your future earnings potential?

– How much income could you lose?

Your ability to earn an income is your greatest asset.

Short term or long term disability can severely disrupt any budget, and if family and loved ones rely on your income, their lifestyle will also be affected.

But how much income could you lose? check out this chart.

– Specific Occupation Costs

Monthly premiums for Income Protection Insurance is calculated based on age, gender, risk, the cover amount, benefit payout duration and waiting period.

In the following scenarios, the estimated premiums are based on non-smoking male and female, both health and age 30.

2. Income protection insurance claims data

The chance of missing months or years of work because of an injury or illness may seem remote, especially if you’re young and healthy and you work at a desk.

Each year, in 54,800 Kiwi households, the primary earner’s income is lost through long-term illness. More than half lose it for six months or more. Unexpected long-term illness is the most likely source of financial hardship for New Zealand families.

To break it down.

That’s equal to 150 Kiwi’s every day, that are impacted by a disability. And the pressure of supporting the family financially, paying the mortgage or rent is on.

The actual claims are evidence that more and more Kiwi’s protect their future income.

And here’s the proof.

3. What affects the cost of Income Protection?

The premiums for Income Protection will depend on a variety of factors.

Age is significant; the younger you are, the lower the premiums are.

Your job and the risks related to your job will have a significant impact on how much you pay.

As late as last week a gentleman that works as a linesman purchased income protection.

His area of expertise and that of an office worker are two completely separate risk categories. Therefore, the linesman’s premiums are higher than those of the office worker.

The same linesman was deferred income protection through a bank as it was considered too risky business for the bank.

However, the cost of an income protection policy will vary based on several factors, including:

- age

- job category, ie. linesman vs office worker

- whether you smoke or have smoked the last 12 months

- the percentage of income you would like to cover

- Agreed Value – max 62.5%

- Indemnity Value – max 75.0%

- the waiting period before the policy pays out

- how long do you want the benefit payout

- health (your current health, weight, family medical history).

Why do women pay more for income protection?

Most New Zealand Income Protection Insurers charge females higher income protection premiums than males, even if risk factors such as age and occupation are the same.

One of the reasons being women are more likely to claim than men, and once on a claim, they are more likely to remain off work for a more extended period.

– Mental Health Discount

A mental health discount is an optional benefit that gives you a 10% premium discount if you choose to have a maximum benefit period of 2 years for any disability claim directly or indirectly related to mental illness.

4. Compare Income Protection Insurance NZ

We’ve partnered with New Zealand’s best Income Protection Insurance providers, with the strongest credit rating, built-in benefits and optional add-on benefits to tailor insurance solutions to fit you and your budget.

Some of the optional benefits include

5. Income Protection Insurance Basics

Income protection insurance in New Zealand is an insurance policy that replaces some of your income if you’re unable to work due to serious illness or injury.

- Most policies in New Zealand will provide you with a monthly payment up to 75% of your total income to keep your lifestyle going during recovery.

- Your income can include any commissions, bonuses or fringe benefits that you are eligible to receive.

- Policies can cover you 2 or 5 years or until 65 or 70.

– Agreed Value vs Indemnity Value Income Protection

Agreed value and Indemnity Value are the two benefit structures that you can choose from when you apply for income protection:

- Indemnity Value: Benefit payout based on income at the time of claim

- Agreed Value: Benefit payout based on your income at the time of application

I can hear you thinking,

– Is Agreed Value or Indemnity Value right for me?

By and large dependent on the nature of your income, if your income is stable or fluctuates.

– What is Agreed Value Income Protection?

When applying for an agreed value income protection policy you will have to provide proof of income. Payslips that are not older than 3 months will do.

Your policy and the sum insured is then based on the value of your income agreed upon by you and your insurer.

– Agreed Value Income Protection Pros and Cons

Pros

- Premiums are tax deductible

- Agreed benefit payout at time when policy is issued

Cons

- Benefit Payout is taxable

- Slightly higher premiums than Indemnity Cover

What is Indemnity Value Income Protection?

You will have to provide financial documentation for your gross income when you make a claim.

And the benefit payout will be assessed based on your gross income.

– Compare Income Protection Insurance Policies

IRD Tax News: Get Tax Rebate with Income Protection Insurance Premiums

Income protection insurance premiums are tax deductible.

Just as the income protection benefit is taxable.

The marginal tax rate in New Zealand is 33%, meaning every dollar over $70,000 income a year, is taxed 33 cents on the dollar.

6. Do you need Income Protection Insurance?

Your most valuable asset is your ability to make a living, your ability to work and earn an income.

If you are disabled, income protection insurance is designed to replace a part of your income.

Recent research finds that more than 1,000 families a week – 54,800 a year, experience a sickness that prevents the primary income earner from working for three months or more.

Such a long away from work could result in a redundancy?

Mental illness can also be disabling, and with income protection insurance in place, the insurer will work with the individual and offer rehabilitation and retraining support.

Maybe a career change would help you get back to work. Because after all, your greatest asset is your ability to earn an income.

Getting help from an HR adviser would help clarify that.

Income Protection Insurance covers 1 in 4 Kiwis.

By comparison, around 4 in 5 Kiwi’s have their vehicles insured.

An income of $60,000 a year for 30 years comes to $1,8 million, much more than the value of most homes.

7. Income Protection Questions

What is Income Protection?

Income Protection insurance pays a regular replacement income of max 75% of your pre-disability income if you are unable to work because of illness or injury.

Why Income Protection matters?

Each year in 54.800 Kiwi households the main earner’s income is lost due to illness or accident, resulting in financial hardship. Income Protection matters because the main earner’s income would be guaranteed.

How long can you be on an Income Protection claim?

Most income protection policies will cover you for 2 or 5 years, or until you are 65 or 70 years old.

How to claim income protection on tax return

Usually your insurance company will send out a letter after the end of each financial year detailing the amount you’ve paid on income protection insurance which you can claim on and is tax deductible.

Should I choose a shorter or longer waiting period?

You can save on your Income Protection Insurance premiums by extending your waiting period. You need to consider if you can finance the waiting period yourself possibly without an income from your employer. Perhaps you have enough savings and sick leave up the sleeve during the waiting period.

How much Income Protection cover do I need?

Typically you can insure 75% of your gross salary free of tax. You won’t be allowed to insure for more than your gross salary, because insurance cannot allow you to make a profit out of your misfortune.

Can I buy Income Protection Insurance while suffering from Endometriosis?

Endometriosis is one of the most common gynaecological conditions affecting income protection insurance in New Zealand. Endometriosis affects about 1 in 10 women and teenage girls.

Our experience when dealing with insurers in New Zealand representing women dealing with Endometriosis, is outcome depends on unique private circumstances. Therefore the offer is unique to you. Probably the best way forward is making us aware upfront of your situation, that we can find the best outcome and not waste your time.

Is Income Protection Premiums tax deductible?

In short, the answer is yes.

And no?

As long as any claim will result in a benefit pay out and is treated as a taxable income, then the income protection insurance premiums are tax-deductible.

On the other hand, if the benefit is not tax deductable, then the income protection insurance premiums are not tax deductable.

As your broker, we will provide the necessary breakdown of premiums each financial year detailing the amount you’ve paid on your premiums and the portion that is tax deductible. Your accountant will love you for it.

How is the process like?

The big questions to consider, when looking into Income Protection Insurance:

How is the application process?

Your premiums vary depending on how risky you are to insure.

At LifeCovered we only work with Insurance Companies that do all the underwriting upfront. The underwriting process is probably the most important part of the whole buying experience because it will determine the offer you receive. And ultimately how you and your family are financially covered.

The application process is generally completed over the phone.

Your adviser will ask a series of questions, which range from your personal details, occupation, income and through to personal and family medical history.

Your application will then be lodged with our insurers; it will then be assessed and underwritten.

An electronic copy of the application will be sent to you as well.

Many wrongly believe that income protection insurance provides cover for involuntary redundancy.

But unfortunately, it’s not that simple.

Income protection is designed to provide you with up to 75% of your wage for a fixed period of time, after a waiting period, if you are unable to work due to illness or injury. Redundancy insurance is not automatically included. However, there are options to included Redundancy insurance to your income protection insurance.

Working as a doctor, nurse, a surgeon or ambulance officer can mean working in a hazardous environment and can carry risks including:

- Exposure to illnesses and diseases: Incidents like needle stick injuries are common for medical professionals, even with all the necessary safety and hygiene precautions.

- Mental illnesses: Data shows that medical professionals are prone to developing medical illnesses.

- Losing a high income if anything happens to you: Some medical profession are high paying, but this also leaves your family and yourself at risk if you are unable to work due to injury or illness.

9. Income Protection for Company Directors, Managers, and Executives

Company Directors, Managers, and Executives face little risk of accidents or physical injury (ACC Cover) but there are other risks to consider.

Anxiety, burnout, stress, depression, and liability is a worry for many Company Managers and Directors due to the pressure and risk of their job.

- Anxiety, Burnout, Stress, and Depression: Managers and executives are often prone to anxiety and stress from the pressures of their work.

- Liability: Managers and executives can be liable when things go wrong. And there are various forms of professional liability insurances for company managers and directors including professional indemnity insurance.

10. Income Protection for Self-Employed & Income-Splitting

If you’re a tradesperson, there are a few things you need to consider before getting Income Protection insurance.

Many self-employed tradies such as carpenters, plumbers or electricians operate their business with their spouse.

And income-splitting means fewer taxes paid. Income-splitting also means ACC benefits get split.

With the right Income Protection Insurance, you can keep your lifestyle going, even when things go wrong.

Other insurances for self-employed Professional Indemnity Insurance, Public Liability Insurance.

ACC

Accident Compensation Corporation shortened ACC compensates as the name implies for accident-related incidents.

For self-employed, ACC offers two disability accident only insurance covers: ACC CoverPlus and ACC CoverPlus Extra.

ACC state on their website that:

“ACC pays up to 80% of your income as weekly compensation if you cannot work because of an injury ACC is covering. This means you’ll still get paid while you recover.”

Two details catch my attention.

Firstly unable to work because of injury and second injury that ACC is covering.

Wow!

While ACC provides cover for specific injuries, ACC does not offer a blanket cover-all solution.

Here is an example of the physical injuries ACC cover. Get the complete overview here.

A physical injury is when there is actual damage to your body. This includes:

- sprains or strains – such as ankle, back, knee or shoulder sprains

- wounds – cut, broken or bruised skin

- burns

- fractures

- dislocations

- dental injuries

- hearing loss

- loss of consciousness.

WINZ

Government benefits are unlikely to cover your living and lifestyle expenses.

You can only claim from ACC if you suffer an accident.

WINZ, Supported Living Payment net weekly benefit to a single person is $269.15.

Supported Living Payment is for people who are not able to work because they are:

- restricted in their capacity for work because of a health condition, injury, or disability or totally blind or

- caring for a person who requires full-time care and attention at home

Compare Best Income Protection Insurance: Get Personal Advise.

There are numerous benefits to having income protection insurance.

Firstly, you are your greatest asset, and ensuring your future income potential is worth a lot of money, peace of mind, and financial stability for you and your family.

Secondly, there are more definite benefits for you to consider, depending on the policy and add-on options you choose.

- Recurrent Disability: Your benefit will continue immediately if you’re affected by the same disability within 12 months of returning to work – waiving your waiting period.

- Disability Reset: Following a claim on your Income Protection Insurance Policy with a two- or five-year benefit, the benefit period will be reset. This allows you to claim for a new or related illness if needed.

- Accommodation: Pays for your family to be with you if they live more than 100km away.

The ones that stand out in the crowd offer a seamless transition to fixed premiums and pay your premiums while on claim.

LifeCovered is a registered financial service provider with the New Zealand Companies Office.