Question

Trauma Insurance vs Income Protection: What is the difference?

Answer

Trauma cover insurance is paid upon a specific diagnosis. Income Protection is paid if you are diagnosed with any medical condition or injured and can't work.

- By Willi Olsen

- Updated

Need Help With Insurance?

Our advisers are here to answer your questions, explore your options, and help get you the right cover.

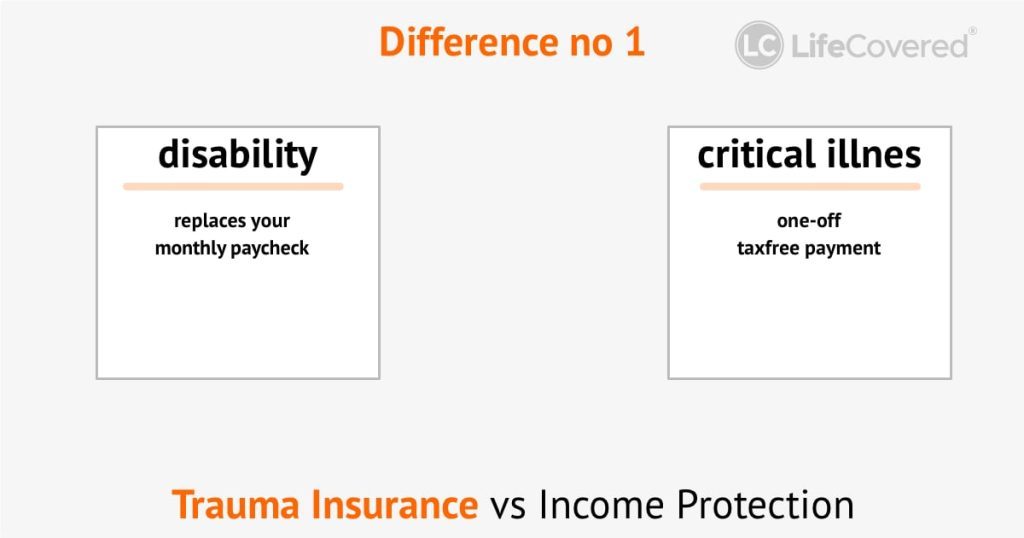

Trauma Cover and Income Protection are both living benefits and very different types of personal protection insurance, and many people ask which policy is best. Life insurance differs from trauma insurance vs income protection, which is a death benefit.

One of the benefits of trauma cover is the tax-free lump sum payment that can help those who suffer traumatic illnesses pay expenses if they cannot work. But many ask if trauma cover is necessary if they already have income protection cover.

Everyone’s financial situation is different, and we always recommend speaking to a financial advisor. In the meantime, here is some information about trauma cover compared to income protection.

Key Points

- Trauma Insurance pays a tax-free lump sum when you are diagnosed with one of the approximately 50 specific medical conditions listed in the policy.

- Income Protection pays a regular benefit when you are medically unfit to work due to any medical condition.

What is Trauma Cover?

Trauma Insurance in New Zealand provides a tax-free lump-sum payment to the insured diagnosed with one of the illnesses or medical conditions covered. Usually, somewhere around 50 different illnesses are included in the coverage.

The insurance benefit is paid upon medical proof of being diagnosed with an illness on the list of covered conditions.

The two main reasons most decide to take out trauma cover are:

- This is to help cover expenses that health insurance doesn’t pay for, such as medication, rehabilitation, and treatments not included in health coverage.

- Fill the shortfall that any income loss would incur and cover any mortgage or rent.

Trauma insurance gives you financial options because the money is paid to your bank account. You decide how to spend it.

All trauma policies are not the same, but most cover the most common medical conditions and illnesses.

A partial list would include stroke, heart attack, cancer and tumours, loss of eyesight, body organ transplants and some neurological conditions such as dementia and paralysis. Trauma policies only allow one claim, however, you can upgrade your policy, upon commencement date, to claim multiple times.

What is Income Protection?

Income protection cover helps replace your income by paying you a regular payment if you cannot work due to:

- Any accident

- Any injury

- Any sickness

- Mental health or stress,

that leads to not being able to work.

With Income Protection, you can protect your income potential for two or five years or until your retirement. You are effectively guaranteeing a portion of your income for the rest of your life.

Agreed value insurance pays you based on your income when you first take out the insurance. Therefore, it is usually the more expensive of the two kinds of income protection cover.

The indemnity value benefit payout is based on your income when you claim it. Therefore, it is riskier for the buyer but also less expensive. In a worst-case scenario, you are working part-time or for less money than you used to make when you become unable to work.

Furthermore, ACC offers accident-only agreed-value disability coverage called CoverPLus Extra.

The cost difference between Trauma insurance and Income protection.

Trauma insurance and income protection premiums are hard to compare side by side because both provide a different type of cover. In an ideal world, we strongly suggest having both benefits.

Income protection policies replace a portion of your monthly salary and are designed to meet the costs of ‘living’, rather than ensuring family members get a payout after your death.

So even if you’re young and single with no dependents and limited fixed expenses, income insurance is very useful. If you have a mortgage and dependents it’s essential.

Trauma insurance vs Income protection: what is better?

Trauma Insurance and Income Protection are equally important. The difference is Trauma cover insurance is paid upon diagnosis. It is not required that the person be unable to work and there is no waiting period. It provides extra money to pay expenses regardless of whether or not you are able to work.

Income protection can only be paid out when you are unable to work. Moreover, the payout is computed by taking a percentage of your earnings. In other words, it is less than you are used to taking home and is tied directly to what you earn.

Should I buy Trauma insurance and Income protection policies?

This depends on what kind of risk you are willing to live with, what kind of insurance would give you the most peace of mind, and what your budget is. Your family and your personal health history might influence the decision too.

Trauma insurance and income protection policies are fairly complex, so we strongly recommend getting unbiased advice from a LifeCovered financial advisor.

Can I get financial advice?

In my experience, no two people have the exact needs and family circumstances.

As an important piece of a sound and robust financial strategy, insurance helps maintain your financial momentum toward goals and secure your financial future.

Our advice process starts with a basic conversation about what is important to you. It’s not the day to decide what to do.

Personalised financial guidance requires a personal connection. We can help.

Click here to schedule a call with Willi.

Need Help With Insurance?

Our advisers are here to answer your questions, explore your options, and help get you the right cover.