Children's Trauma Insurance

Provide for your child’s medical needs if your child becomes critically ill

What is Children's Trauma Insurance?

Children’s Trauma Insurance, (or critical illness cover) pays you a tax-free benefit if you are diagnosed with one of the 50 plus critical illnesses (including cancer, heart attack and stroke) that meet policy definition, and you must survive for 14 days after diagnosis.

If you don’t survive, there is no pay-out. For this, you will need life insurance.

Do I need children's trauma insurance?

Our children are the closest to our hearts. And considering children’s trauma insurance can be a touchy subject for us parents.

Nobody wants to think of the worse that can happen.

Even more heartbreaking the situation can be for the parents if there is no money available to pay for medical and living expenses through the period.

Children’s Trauma Insurance is a policy that helps parents support the whole family through a difficult time and allows them to take time off work to be there for their child.

If your child were to become critically ill, it’s vitally important to know that you can provide for your child’s medical needs, cover any incurred costs, and give your child your undivided attention

Which critical child illnesses are covered?

There are a couple of life insurers in New Zealand that offer children’s trauma insurance with various cover range, but most commonly covered critical illnesses are:

- Cancer

- Heart & Arteries

- Brain & Nerves

- Loss of Function

- Other health events

How does it work?

It’s important to consider the situation carefully if a child becomes sick. Both parents and the childrens needs must match to get the best outcome.

Trauma and Health insurance can be a powerful combination for a family with children – health insurance can cover medical bills such as grommets or surgery.

Then in a serious, longer-term situation, trauma insurance can step in and support the whole family.

There are two ways a child can be covered:

Covering children under their parent’s insurance

- Trauma: built-in and optional benefits

- Works as foundational financial support should a child suffer a serious illness or injury

Standalone insurance for children

- Trauma and Health options

- The child is the life assured on the policy, providing them with comprehensive cover

- Parents or legal guardians are the policy owner until child is 16 years old

Critical illness costs

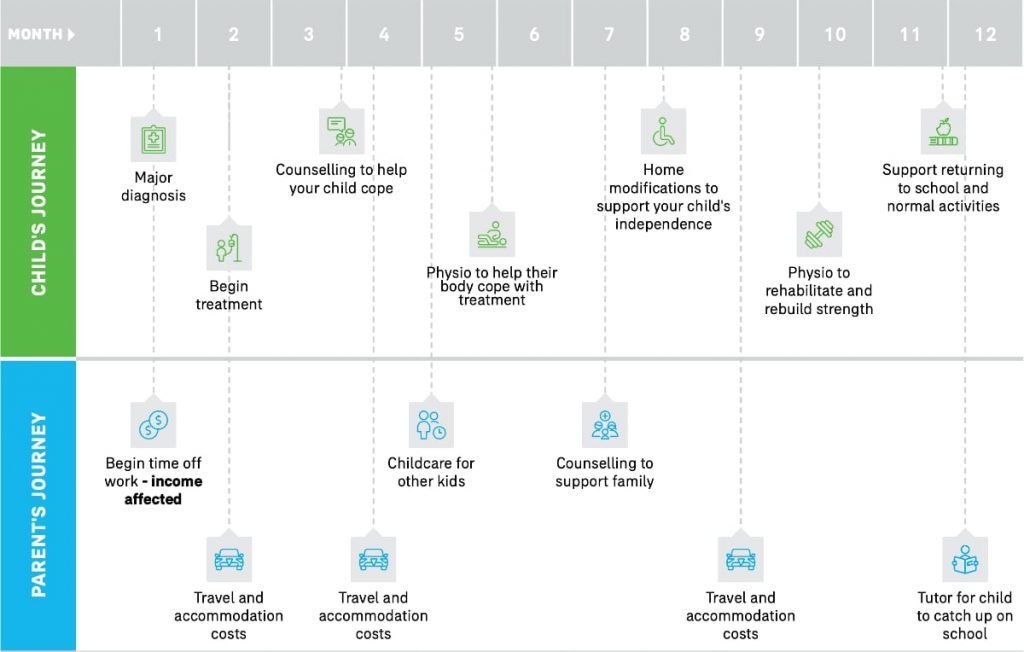

This example illustrates the potential family experience that may unfold following a child being diagnosed with a critical illness, such as Leukaemia.

There can be many unexpected costs the family may not have considered, in addition to their expected, regular household costs. Having standalone insurance for children can help parents support the whole family through a difficult time and allows them to take time off work to be there for their child.