Question

What is Accelerated Trauma Insurance?

- By Willi Olsen

- Updated

The accelerated trauma cover payout is deducted from your life insurance policy when diagnosed with a critical illness and have accelerated trauma insurance.

One of the most common ways to buy trauma insurance is to include it as an extra benefit on a life insurance policy because of the sharper price plan and more comprehensive cover.

Accelerated trauma cover definition

Accelerated trauma cover is added to a standard life insurance policy. It pays out when you are diagnosed with a specific critical illness covered by the policy or upon death, whichever occurs first.

Example

Steve took out a life insurance policy for $150,000 and upgraded it to include the accelerated trauma plan of $100,000. Steve was just diagnosed with a critical illness covered by the policy. What benefit would Steve get?

If Steve died, the remaining $50,000 would be paid to his estate or policy beneficiaries.

What are the different types of trauma insurance?

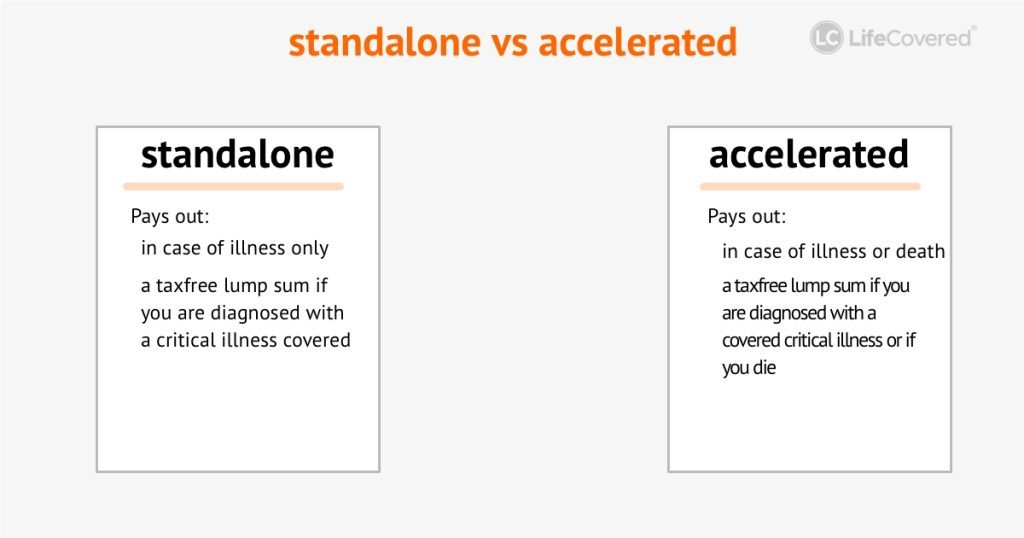

Standalone and accelerated are the two main types covering the same amount of illnesses. The following is a breakdown of each:

- Standalone cover

This is a separate insurance benefit that only covers you upon diagnosis of an illness listed in your policy.

- Accelerated cover

This is a trauma insurance policy combined with life insurance cover, meaning you’re covered for both illness and death – whichever happens first.